Structured Products

ETF

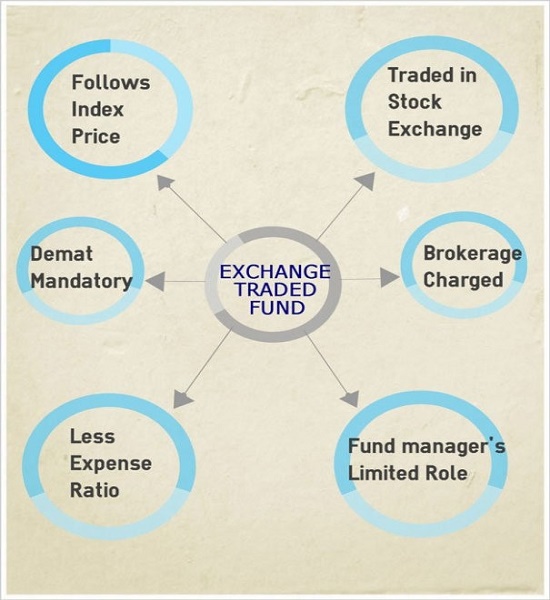

An ETF is a basket of stocks that reflects the composition of an Index, like S&P CNX Nifty or BSE Sensex. The ETFs trading value is based on the net asset value of the underlying stocks that it represents. Think of it as a Mutual Fund that you can buy and sell in real-time at a price that change throughout the day.

ETF

The real estate sector in India has been lucrative for savvy investors over the last decade, but it has not been without accompanying uncertainties. The introduction of REITs (Real Estate Investment Trusts) will open up a platform that will allow all kinds of investors — even those with smaller budgets — to make safe and rewarding investments into the Indian real estate market.

The REIT platform has already been approved by the Securities and Exchange Board of India (SEBI) and like mutual funds, it will pool the money from all investors across the country. The money collected from the REIT funds will subsequently be invested in commercial properties to generate income.

A REIT will need to be registered via an IPO or initial public offering. REIT units, as such, will have to get listed with exchanges and consequently traded as securities. The SEBI board has kept the minimum asset sizes to be invested in at ₹500 crore. However, the minimum issue size would have to be less than ₹250 crore. As with stocks, the investors here would be able to buy the units from either primary and/or the secondary markets.

REITs are a process to generate funds from a lot of investors to directly put their money in profitable properties like offices, residential units, hotels, shopping centres and warehouses. All trusts with REITs will be listed with stock exchanges as they would be structured like trusts. Consequently, REIT assets will be held with independent trustees for unit holders / investors.