SYSTEMATIC INVESTMENT PLAN

SIP -UNLOCK THE POWER OF COMPOUND INTEREST AND RUPEE COST AVERAGING

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.”

“Dirghah” the word says the all about the investment- long term and discipline. Financial discipline is one of the most important thought and obedience required by all of us in this world.

Sometimes the hardest thing about saving money is just getting started. It can be difficult to figure out simple ways to save money and how to use your savings to pursue your financial goals. Money-saving habits can help you develop a realistic savings plan.

Systematic Investment Plan (SIP) is an investment plan (methodology) offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund scheme periodically, at fixed intervals – say once a month, instead of making a lump-sum investment.

The SIP instalment amount could be as little as ₹500 per month. SIP is similar to a recurring deposit where you deposit a small /fixed amount every month.

SIP is a simpler approach to long term investing is disciplining and committing to a fixed sum for a fixed period and sticking to this schedule regardless of the conditions of the market.

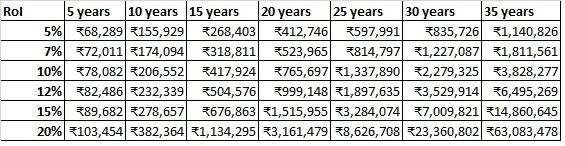

Power of Compounding with Rs1000 invested everymonth

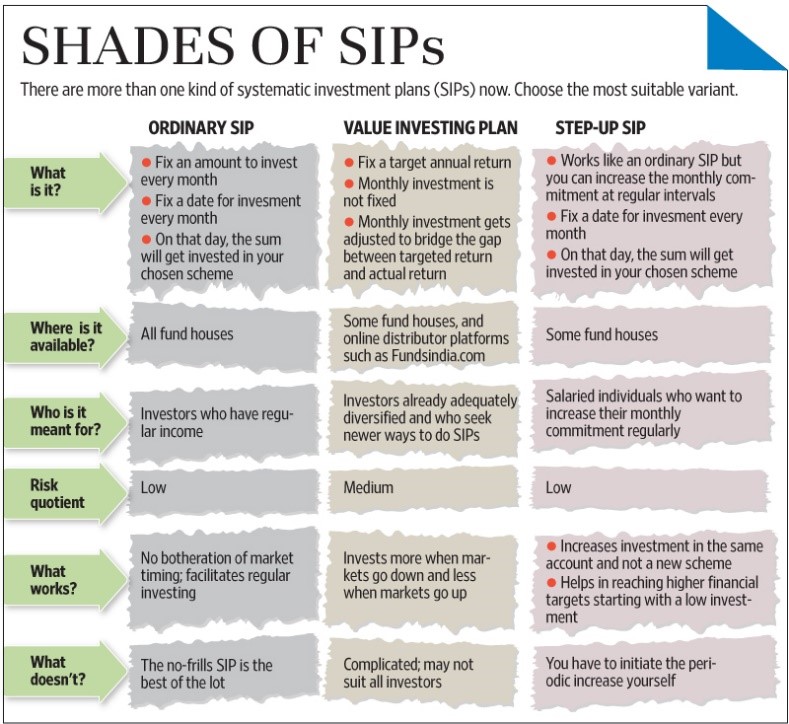

Types of SIP